60+ your mortgage statement should always come from your lender

A bank or other lender agrees to. Web Starting with mortgage basics a mortgage is a loan used to purchase different types of real estate including a primary home.

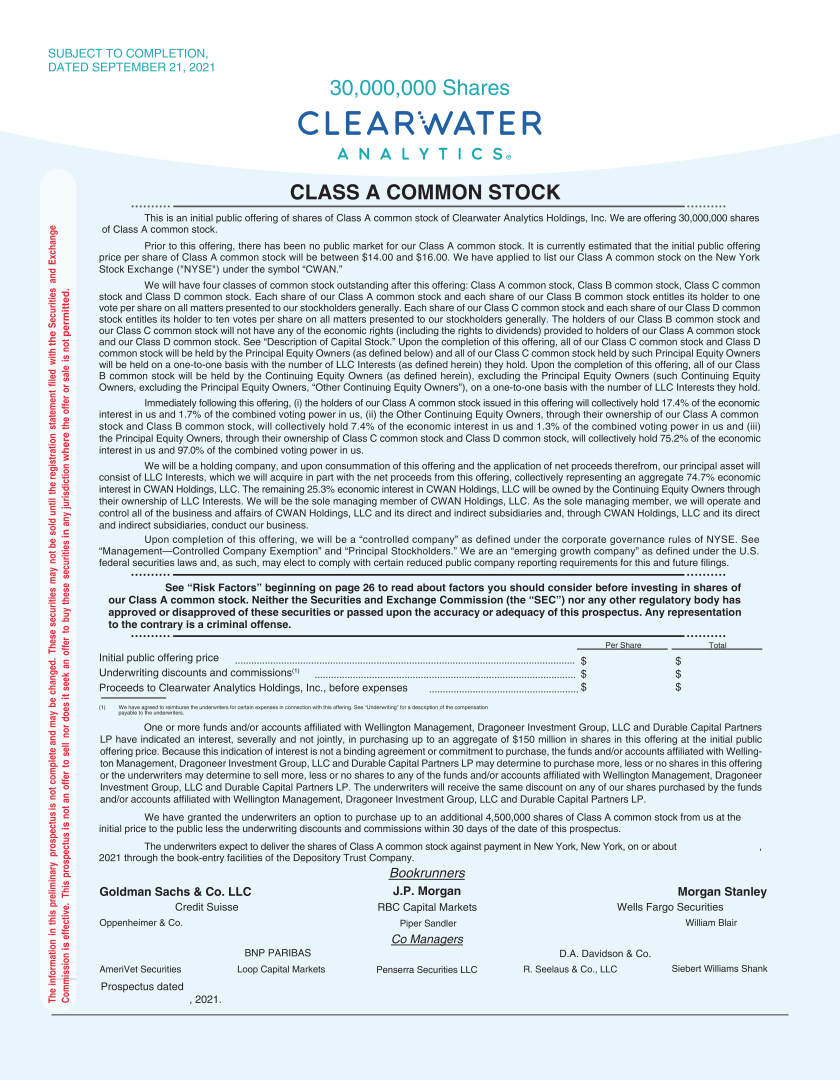

S 1 A

Web Mortgage underwriters are trained to uncover unacceptable sources of funds undisclosed debts and financial mismanagement when examining your bank.

. You can get free weekly credit reports from each. If your loan is a closed-end loan secured by a. A proof of deposit.

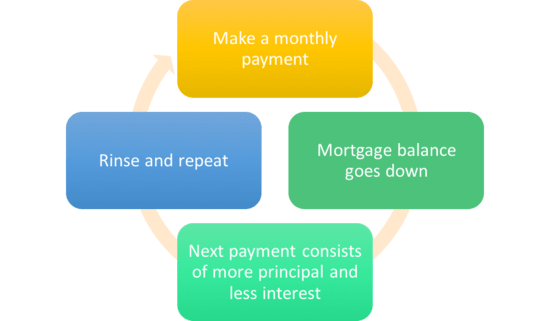

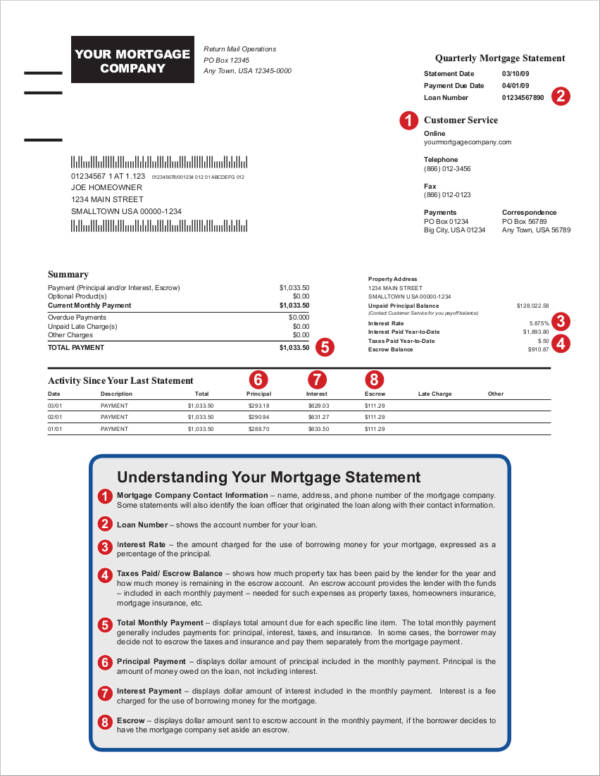

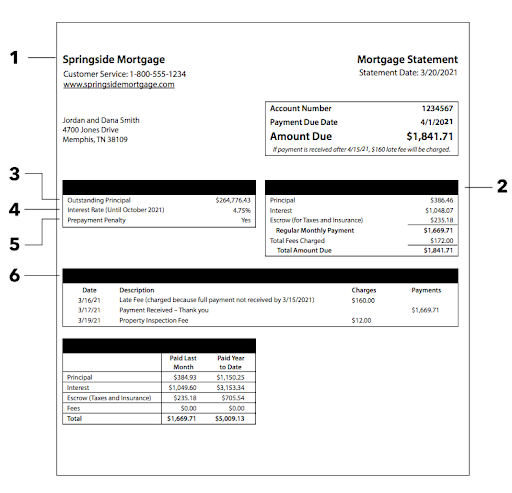

Web But mortgage lenders are also legally allowed to ask about an applicants ethnicity marital or divorce status and whether the applicant is part of a lawsuit. Web Mortgage Statement as Documentation. It typically is sent every month and includes how much you owe.

Web A closing disclosure is a five-page form that federal law requires lenders to complete and give to borrowers before closing. Web Now comes the mortgage statement a document that comes from your mortgage loan servicer. Web If you are considering paying off your mortgage you can request a payoff amount from your lender or servicer.

The form puts the loans key. Web A mortgage statement is a document from your lender that provides up-to-date information about your mortgage loan. A coverage plan that covers your homes structure your personal belongings and liability in the event of damage or injury.

Web You also should check your credit report after 30 to 60 days to make sure it shows your mortgage was paid off. Web If your loan is sold to a new lender. Expect to receive a separate notice from the new lender.

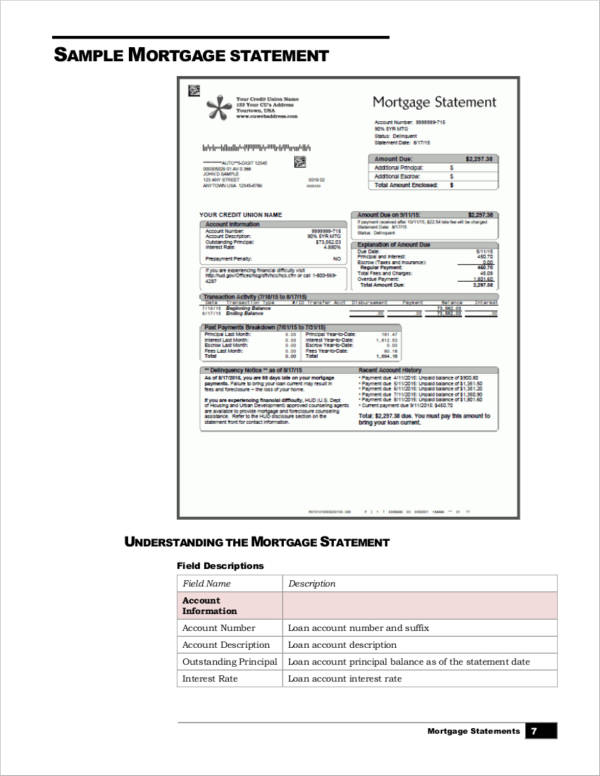

Web A mortgage statement is a document detailing the information of your loan. Web Mortgage lenders do this to make money and to raise capital to make new loans. Federal law under the Real Estate Settlement Procedures Act RESPA allows lenders to.

-is the best description of the. Web The lender needs to verify that the funds required for the home purchase have been accumulated in a bank account and accessible to the lender. Web Your statement will include a if paid after amount that includes a late fee which is typically charged if you make your payment after the 15th of the month.

Your mortgage statement is a useful document that can help you keep track of your mortgage loan. This is due to you within 30 days of them taking ownership of the loan. Web The monthly payment on a 30-year 100000 loan at 4 percent is 47742 with a total interest cost of 7186951.

Web How to use your mortgage statement. On your mortgage statement you will find. You will receive a mortgage statement every billing cycle.

Web Send your letter and copies of any documents that support your request to the mortgage servicers customer service address by certified mail and request a return. If a borrower is considering selling the property or considering refinancing with another lender a current mortgage statement is nearly.

Free 9 Mortgage Statement Samples And Templates In Pdf

Mortgage Amortization Learn How Your Mortgage Is Paid Off Over Time

Free 9 Mortgage Statement Samples And Templates In Pdf

Mortgage Statements What They Are How To Read Them Sofi

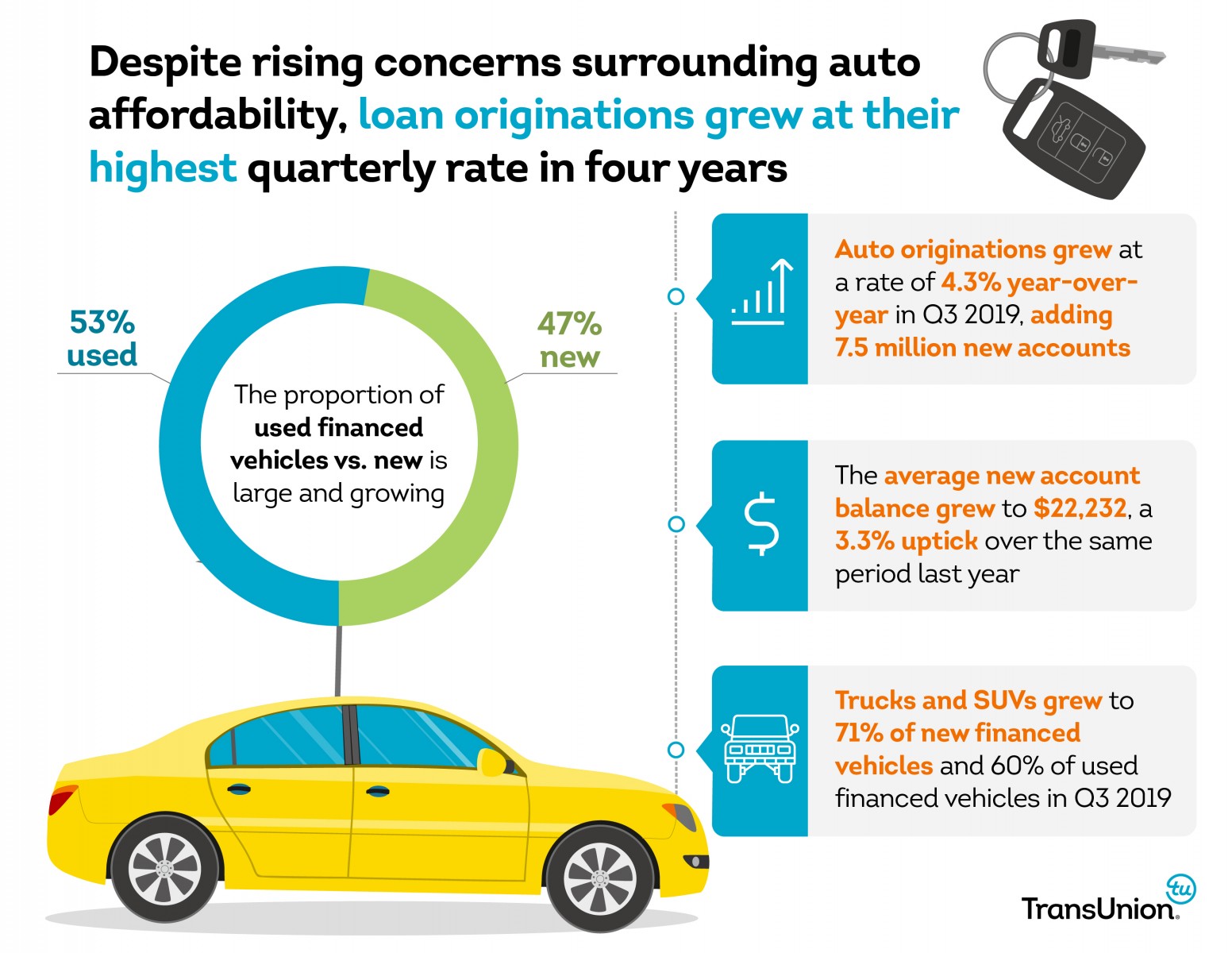

Auto Market Shows Resiliency As Originations Grow

The Mortgage Loan Process By Adrean J Rudie Ebook Scribd

Fintech Magazine September 2022 By Fintech Magazine Issuu

The Small Mistakes That Will Cost You Your Mortgage Expert Advice Express Co Uk

Deciphering Your Mortgage Statement Financial Pipeline

Mortgage Statements What They Are How To Read Them Sofi

Official Statement Fiscal Advisors

60 Ltv Mortgages Our Best Rates

11 Things You Must Know Before Buying A House Hubpages

3 Reasons Why Lending Companies Should Use Open Banking Salt Edge Blog

Should You Pay Off Your Mortgage In Retirement Tiaa

Flexible Mortgage Payment Features Td Canada Trust

What Is A Mortgage Statement Zolo Ca